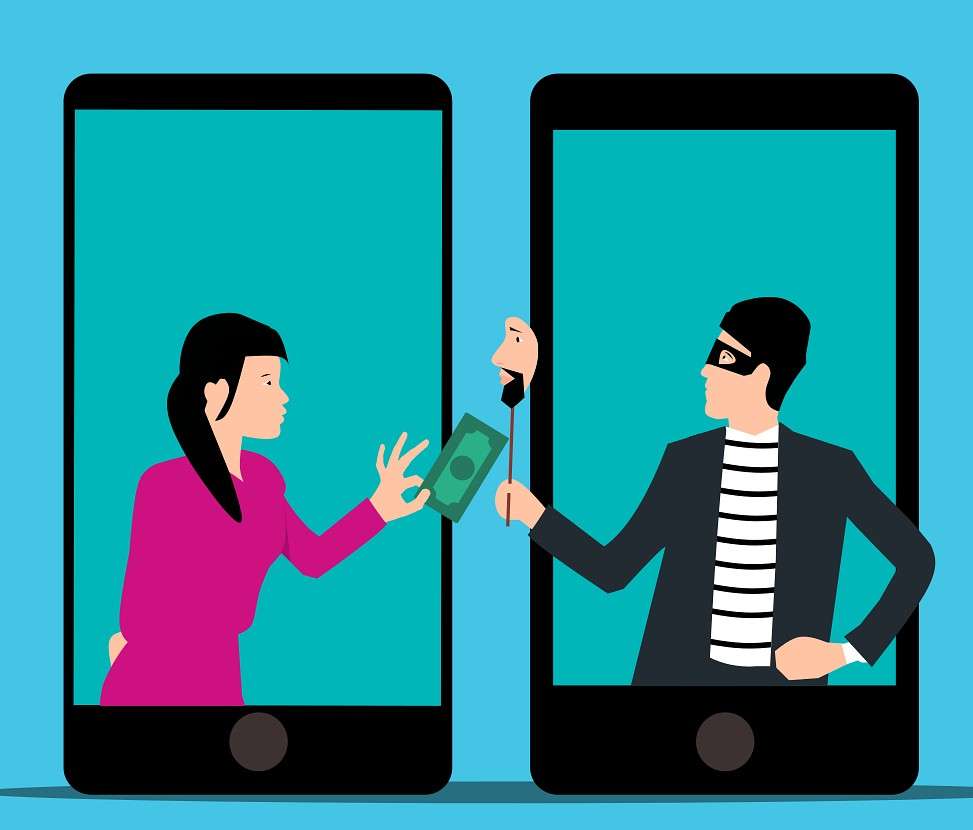

Zelle was supposed to be the bank-backed, scam-proof answer to Venmo and PayPal. Instead, according to a new lawsuit from New York Attorney General Letitia James, it became a tool for scammers, costing consumers over $1 billion between 2017 and 2023.

At the center of the case is Early Warning Services (EWS). The company that runs Zelle and is jointly owned by some of the nation’s largest banks: Bank of America, JPMorgan Chase, Capital One, and Wells Fargo. James alleges EWS knew for years that Zelle’s design left users exposed to fraud but failed to put in even the most basic safeguards.

How Did a “Safe” Payment App Become a Fraud Magnet?

The lawsuit claims that the app was rushed out to users, with security taking a backseat. Zelle’s signup process required little more than an email address or phone number linked to a bank account. No rigorous identity checks or to deter bad actors.

Scammers could impersonate businesses or government agencies, tricking people into sending money for fake bills or phony emergencies. The details shown in Zelle transactions were so limited that even cautious users could be fooled by a well-crafted scam. And once money was sent? That was it. Zelle’s transactions were instant and irreversible.

The Banks Allegedly Looked the Other Way

According to the complaint, EWS and its partner banks were fully aware of the rising fraud but resisted implementing stronger anti-fraud rules. Even when security upgrades were proposed in 2019, they were delayed, leaving the platform vulnerable for years.

One example in the lawsuit is a New Yorker who wired nearly $1,500 to a fraudulent account posing as a utility company. They never got their money back and they weren’t the only ones to be fooled like that.

James’s office argues that Zelle not only failed to remove known fraudsters from its network but also misled the public by marketing itself as a secure way to send money.

The Stakes Go Beyond New York

This isn’t just a New York problem. If the allegations are true, users in other states could have faced similar scams. This raises the possibility of more lawsuits and regulatory crackdowns. The scale of potential liability for EWS could be enormous, especially if courts begin forcing reimbursement for past victims.

Zelle’s response so far has been to call the lawsuit a political move, insisting the company is committed to stopping fraud. However, for millions of users who lost money, the damage is already done.

Protecting Yourself Going Forward

For New Yorkers (and really, anyone who uses Zelle) the Attorney General’s office recommends:

- Report fraud to the New York Attorney General’s Consumer Frauds Bureau to aid in investigations and possible restitution.

- Verify whoever you’re sending money to independently beforehand. You should definitely do this if someone contacts you out of the blue, claiming to represent a business or agency.

- Use your bank’s protections like transaction alerts or spending limits.

- Stay informed about Zelle’s security changes and adopt any new safeguards.

If a payment platform jointly owned by America’s biggest banks can be this vulnerable, what does that say about the priorities of the financial industry?

The New York lawsuit could be the start of a long, messy legal fight. It could redefine how much responsibility payment platforms have to protect their users, even when those platforms are bank-built.