Summary (TL;DR)

It seems logical that businesses charge based on what an area can afford, but that’s not fair. Older folks get priced out of their homes by gentrification, basic groceries cost more in poorer areas, and online pricing can target those who seem wealthy. This unfair pricing hurts individuals and recent data shows it especially burdens low-income households. Solutions include transparent pricing, basing fees on the value of the work instead of a customer’s income, and community-based models. In today’s connected world, businesses that treat customers fairly build trust and last longer, proving that ethical practices are good business too.

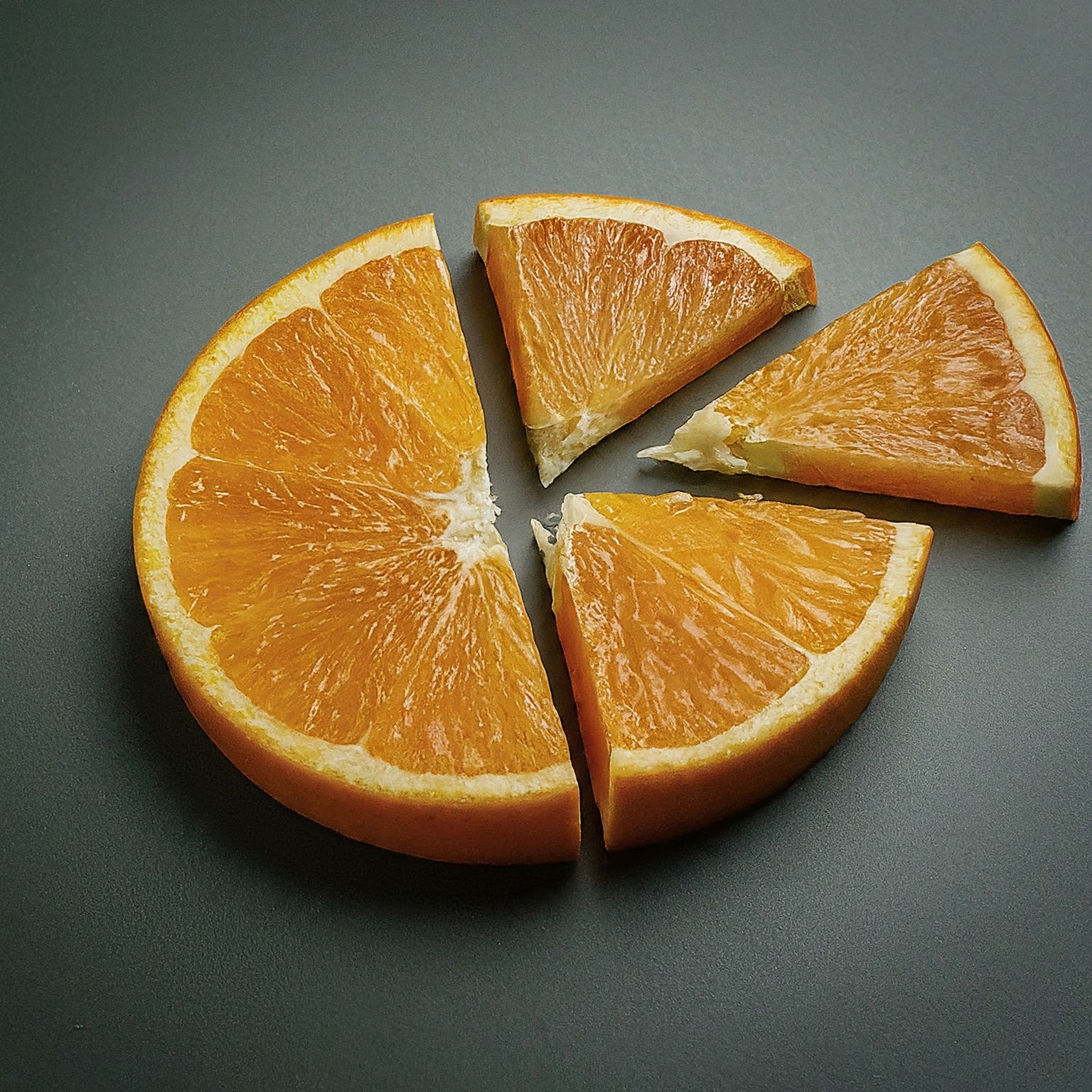

It might seem logical for a store in a wealthier neighborhood to charge higher prices than one in a less affluent area. After all, businesses often base their pricing on what their local market will bear. However, this seemingly practical system has inherent flaws and creates fundamental unfairness. We need to expand the conversation about how to ensure fair pricing for goods and services across all income brackets.

Recent government data further highlights why this is critical. According to a Congressional Budget Office (CBO) report, low-income households have been disproportionately affected by recent inflation [cite report]. Even basic necessities have become significantly more difficult to afford for many. This article will explore the challenges people of different income levels face and proposes solutions to create a more equitable system for pricing essential goods and services.

Challenges Faced by Different Income Groups

Aging Population – Caught in the Middle

Imagine an older couple who bought their cozy home decades ago, drawn to a neighborhood that was affordable and family-friendly. Over time, their community changes. Trendy shops and upscale cafes appear, driving up rents and pushing out older businesses. Unfortunately, this isn’t some isolated incident: it’s the story of gentrification. While revitalization of a neighborhood can have benefits, there is a dark side. Long-time residents like our older couple, often living on fixed retirement incomes, suddenly find themselves priced out of the place they call home. The cost of groceries, utilities, and even basic repairs skyrockets, but their income has not.

Income Disparity and Essential Goods – Cost of Living Crisis

Neighborhoods are not created equal when it comes to the prices of necessities. Imagine two grocery stores within the same city, located in neighborhoods with significant income differences. Basics like milk, bread, and fresh produce often cost significantly more in the lower-income area. This isn’t simply anecdotal; data supports how basic goods are unequally priced. The recent Congressional Budget Office (CBO) report titled “How Inflation Has Affected Households at Different Income Levels Since 2019” highlights this alarming disparity. The CBO found that inflation has created a greater burden for lower-income households – the very people who can least afford rising costs.

Income-Contingent Online Pricing – The Danger of Assumptions

The problem of unfair pricing extends beyond physical storefronts. Online businesses sometimes use “dynamic pricing” models, where the price you see is tailored based on factors like your location or even perceived wealth. While this aims to maximize profit, it’s inherently unfair. You could be quoted a higher price than someone else for the exact same service simply because an algorithm assumes you have more money to spend. This model destroys trust, as consumers discover discrepancies or learn a “wealth signal” triggered higher prices.

Solutions for Pricing Fairness

Transparency and Standardization: The Power of Informed Choice

The first step toward fairer pricing is transparency. Businesses should clearly communicate their pricing structures with all customers. Whenever factors besides the product or service itself influence price, this should be clearly outlined. If there are additional costs for specific locations, premium supplies, or rush delivery, break these down so customers can make informed choices. While some price variation will always exist due to real-world costs, removing guesswork fosters trust between consumers and businesses.

Value-Based Alternatives: Shifting Away from ‘Ability to Pay’

Instead of a singular focus on a customer’s perceived ability to pay, businesses should consider pricing models that emphasize the inherent value of their work:

- Hourly or Project-Based: Charging a standard rate per hour, or a transparently set price for a complete project, ensures fairness regardless of your client’s income.

- Tiered Services: Offering basic and premium packages allows clients to self-select based on their needs and budget.

Community and Government Support Models: Bridging the Gap

We cannot expect businesses alone to solve systemic issues created by income inequality. Here are ways that community initiatives and government policies can promote fair pricing, especially for essential goods and services:

- Subsidies and Tax Breaks: Programs that subsidize the cost of necessities like groceries or utilities in lower-income areas can make a huge difference. Tax breaks for businesses that adopt ethical pricing in these same areas are another incentive.

- Cooperative Models: Community-owned businesses, where profits are reinvested into improving services rather than maximizing shareholder returns, put needs before pure economics. These models work well for things like grocery stores or utility providers in underserved areas. One specific example is the Community Supported Agriculture (CSA) model, where members pay upfront for a share of a farm’s harvest. This gives farmers predictable income at the start of the season and guarantees locally-sourced produce for members, often at a lower price than in grocery stores.

Ethical Business Practices in a Connected World

The Importance of Reputation: Fairness Builds Trust

In today’s “Share Era,” consumers are more connected and informed than ever before. A simple online search can reveal a company’s pricing practices, both good and bad. Businesses that prioritize transparency and fairness build a reputation as trustworthy, attracting customers who value ethical consumption. This leads to greater loyalty and positive word-of-mouth, which are crucial for long-term success.

The Risk of Exploitation: Short-Term Gain vs. Long-Term Loss

Predatory pricing models based on maximizing profit from those perceived as wealthy may yield short-term gains, but ultimately backfire. Customers who feel exploited are unlikely to be repeat customers. Let’s look at some examples of this backfiring in real life:

- Pharmaceutical Companies: Some pharmaceutical companies have been notorious for inflating medication prices, especially for life-saving or essential medicines. This has led to public outrage, government investigations, and boycotts. While immediate profits can surge, long-term damage to the company’s reputation, and public pressure for regulations, can lead to significant losses over time.

- Ride-Sharing Apps: Surge pricing during peak hours or emergencies is meant to incentivize more drivers. However, when those prices become exorbitant, it turns into exploitation. Customers feeling gouged may switch to competitors or find alternative transportation methods. This creates less loyalty and undermines the platform’s appeal, especially with the rise of alternative ride-sharing apps.

- “Shrinkflation” in Grocery Stores: This tactic involves reducing product sizes while keeping prices the same, essentially a hidden price increase. While initially boosting profits, consumer watchdog groups expose such practices. Savvy shoppers notice the change and may switch brands or stores altogether, harming the company’s bottom line.

- Payday Loan Companies: These businesses offer short-term loans with extremely high-interest rates, often targeting desperate individuals in low-income communities. While predatory lenders can profit initially, they face scrutiny from consumer protection groups and stricter regulations. The negative PR and potential lawsuits often overshadow any short-term gains, and these businesses become less viable over time.

These cases show how negative reviews, declining consumer loyalty, and potential legal challenges can seriously harm a brand’s image and long-term success.

Counterargument: “But Won’t Fair Pricing Hurt Profits?”

Some businesses mistakenly believe they must squeeze every penny out of high-income customers to survive, especially in lower-income areas. This misconception misses the bigger picture. Community models, government support, and adjusted operating costs can all work alongside fair pricing to ensure business viability. Additionally, the CBO report underscores a critical point: lower-income households are disproportionately burdened by current unfair pricing. By making essential goods and services more accessible to more people, businesses actually create new markets for themselves.

The Power of Shared Values in The Ethical Marketplace

Ethical business practices aren’t just a feel-good strategy; they are increasingly becoming a competitive advantage. Consumers are prioritizing businesses that align with their values, including fair treatment for everyone. By openly embracing ethical pricing, companies appeal to this growing market segment of conscientious consumers, solidifying their competitive edge.

Where Do We Go From Here?

Fairness in pricing is not synonymous with equality. In a complex economy, it’s unrealistic to expect everyone to pay the same for everything across all circumstances. Instead, fairness means being mindful of how our pricing systems impact people of all income levels. It means recognizing that the current over-reliance on a customer’s perceived ability to pay creates an inherently unfair system, exacerbating existing inequalities.

Solutions won’t be one-size-fits-all. Moving towards fairer pricing requires a combination of individual accountability and systemic change. Businesses need to adopt ethical, value-based pricing models, prioritizing transparency over exploitation. Communities can create cooperative models that put people before profit, especially for essential goods and services. Government policies like subsidies or tax incentives can provide vital support in areas underserved by traditional market structures.

This transformation benefits everyone. When low-income consumers are not priced out of essentials, their quality of life and purchasing power improves. Businesses that build their reputation on fairness and trust foster loyalty and longevity. This shift ultimately creates a more sustainable and equitable economic model for all.

The issue of income disparity and unfair pricing is deeply connected to broader conversations about social justice and economic opportunity. By taking steps as both businesses and consumers towards fairer systems, we take a step toward creating a world where everyone has the resources they need to live a dignified life, regardless of their income level.