Why does it feel like the system is rigged so that newly minted millionaires pay less tax, fresh factory jobs go begging and everyone else carries the weight?

Million-dollar Twitch streams and the new wealthy

Let’s start with a concrete example: a group of young gamers affiliated with FaZe Clan ran a subathon on Twitch and racked up 327,273 subscriptions in one month. Well over a million dollars in that time, even before counting additional bits donations or sponsorship deals.

They weren’t born into massive wealth. They built this. It’s good for them. It raises a question: as people transition from modest beginnings into million-dollar incomes, what happens to fairness, taxes and the larger economy?

Here’s one issue: tax breaks given to high-wealth individuals. When someone becomes “rich,” pays less tax (in effective percentage) than the middle class, the signal is clear: the system shifts in favor of wealth accumulation.

The labor shortage paradox

Meanwhile, across the US manufacturing sector, there’s a looming gap. According to a study by Deloitte and The Manufacturing Institute, to meet demand by 2033 the sector will need about 3.8 million new workers. Roughly half of those jobs (≈ 1.9 million) could go unfilled if current trends persist.

Why does this matter? For capitalism to “work,” as the common narrative goes, there have to be people doing production, manufacturing, service, the often not-glamorous work that keeps the machine running. If we’re creating millionaires in digital entertainment while factory floors in Ohio, Michigan, etc remain understaffed, something is disconnected.

So when I ask: “Who is going to work in those manufacturing plants?” I’m pointing at the obvious mismatch. The newly wealthy Twitch stars? Highly unlikely.

The tax policy that plays into inequality

Enter the One Big Beautiful Bill Act (OBBBA), signed July 4, 2025. Among its provisions:

- It raises the federal estate and gift tax exemption to $15 million per individual (and $30 million for married couples) starting 2026, indexed for inflation.

- It makes this higher exemption permanent (no automatic sunset).

- The law also includes major tax breaks for businesses, and spends cuts to social-safety net programs (for example, changes to SNAP and Medicaid) to offset revenue losses.

What does that mean in plain terms? If a married couple wishes to pass $30 million to their heirs (or as lifetime gifts) starting 2026, they can do so tax-free at the federal level, provided it stays under the exemption. If the top tax rate was 40 % above that threshold, the saving is about $12 million. (40 % of $30 m = $12 m).

Your average middle‐class person? None of this applies to them. They don’t have the billions to pass. They are still subject to normal taxation and the system expects them to plug into the labor machine and consume the output.

The myth of “the poor are a drain”

Frequently you’ll hear the idea: poor people don’t contribute to the economy, they’re a drag on it. That’s wrong. The reality is that money given to low-income households doesn’t sit stagnant. It goes right back into the economy. They spend it on goods and services they need.

Contrast: when the rich stash money in investment accounts, tax-sheltered vehicles, or pass it on in a tax-exempt way, that wealth doesn’t circulate in the same way. It might generate returns but those returns benefit fewer people, rather than broad consumption or production.

In other words: the poor are not the drain. The system which enables extreme wealth accumulation without commensurate contribution can become one.

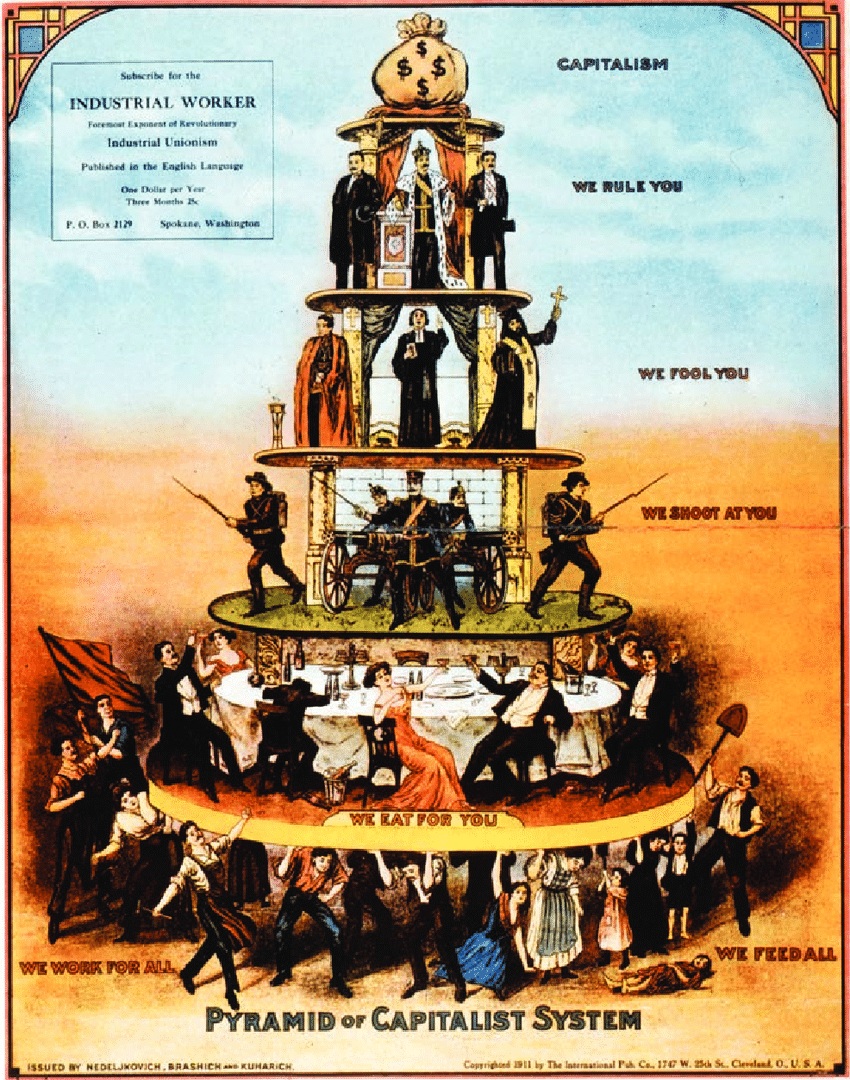

Capitalism, the pyramid and preservation of the bottom tier

Here’s a blunt observation: For capitalism (in its current model) to keep functioning as advertised, there needs to be a large base of people who work, buy, make, service and keep it all moving. Without that bottom tier, the “top” tier might collapse or become disconnected.

Which is why when many people keep voting for parties or policies that favor the wealthy, despite being in the bottom tier themselves, it feels self-undermining. The pyramid stays intact because the base keeps believing the system will reward them too, even as the rules shift. And they are shifting.

Why this matters: the big issue behind the headlines

When you tie together all these threads:

- Young “digital creators” becoming millionaires through platforms and paying lower effective taxes.

- A looming manufacturing labor shortage (3.8 million jobs by 2033, possible 1.9 million unfilled) while millionaires don’t fill them.

- Tax laws that raise exemptions for the wealthy and cut safety nets for the poor.

- Consumption and production being driven by broad participation (not concentrated wealth).

You end up with a structural imbalance: wealth concentrates, production requires people, consumption rests on many people, yet the many are taxed more (proportionally) and carry the burden.

The rich should pay proper taxes. The poor are not a drain on society. The system is. If we want a fairer economy, one where participation is meaningful and reward is just, then tax policy needs to reflect contribution, not privilege. The labor shortage warns us: you can’t create wealth at the top and expect the engine to keep running without the foundation.

A tax-system built for the few weakens the many. When the many weaken, the machine stops.